Overview

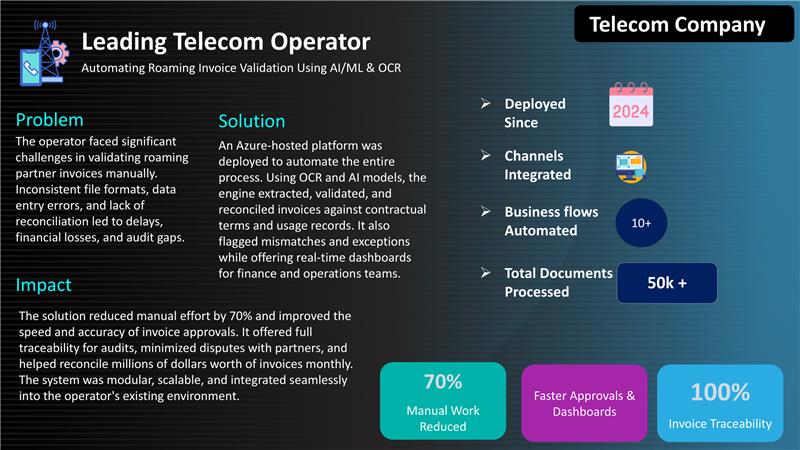

As part of its global telecom partnerships, a leading Middle Eastern telecom operator receives roaming invoices from multiple partners worldwide. Each invoice needs to be validated for accuracy, consistency, and adherence to agreed-upon terms—posing significant manual effort and financial risk due to the diversity in formats, volume, and complexity of data.Business Challenge

Validating invoices from global roaming partners is a tedious process, especially when each partner follows its own billing structure, currency, tax regulations, and invoice format. The operator's finance team struggled to manually:- 👉 Extract and interpret invoice data in PDF, Excel, and scanned formats

- 👉 Match invoice entries with internal records like purchase orders (POs) and usage summaries

- 👉 Flag discrepancies or overcharges for further investigation

The challenge was to implement a smart, automated validation system without disrupting existing infrastructure or requiring integration with the OSS/BSS layer.

Our Approach

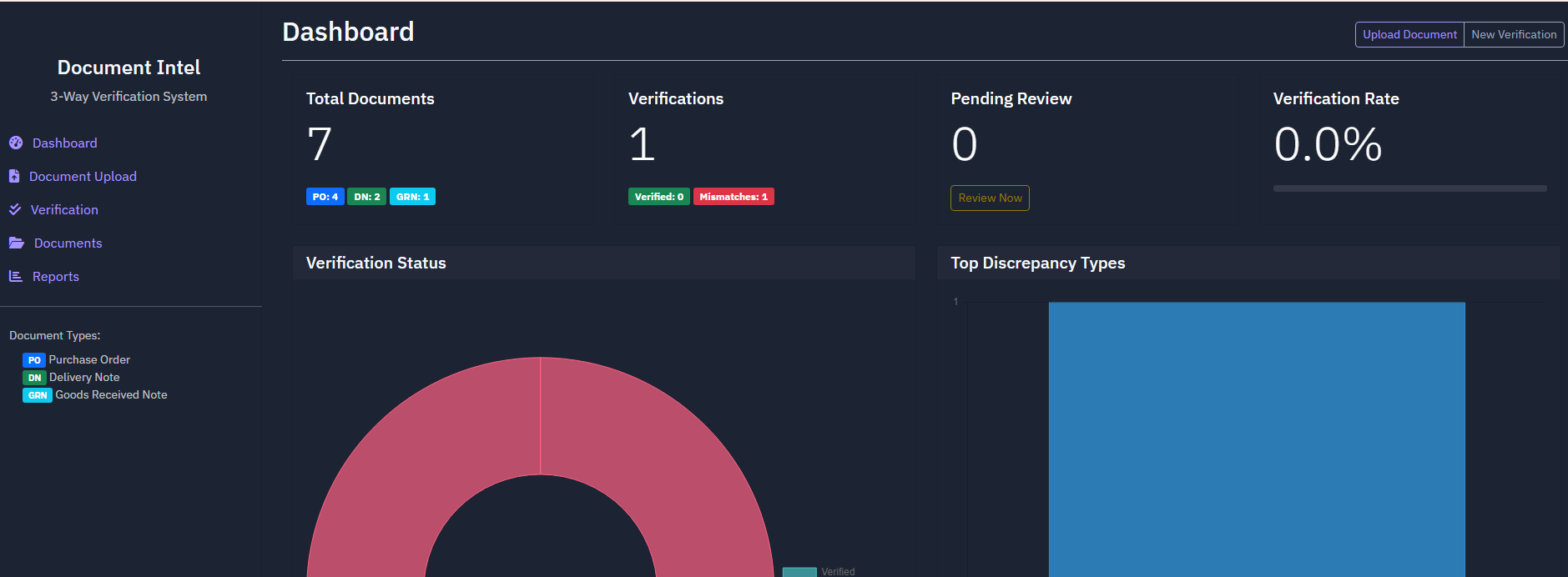

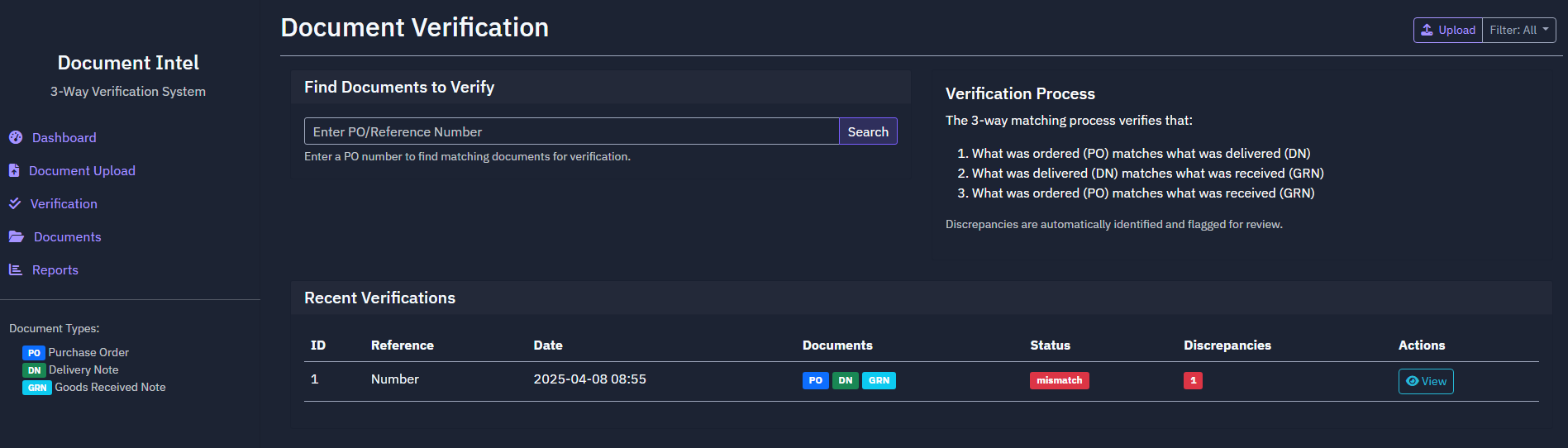

We built a non-intrusive, AI-powered invoice validation platform to automate 3-way matching between:- 👉 Partner-submitted roaming invoices

- 👉 Operator-issued POs

- 👉 Agreed contract terms and usage data

The system uses OCR and AI/ML models to intelligently extract, normalize, and validate invoice data, delivering speed, accuracy, and scalability to the finance team.

Key Technologies Used :

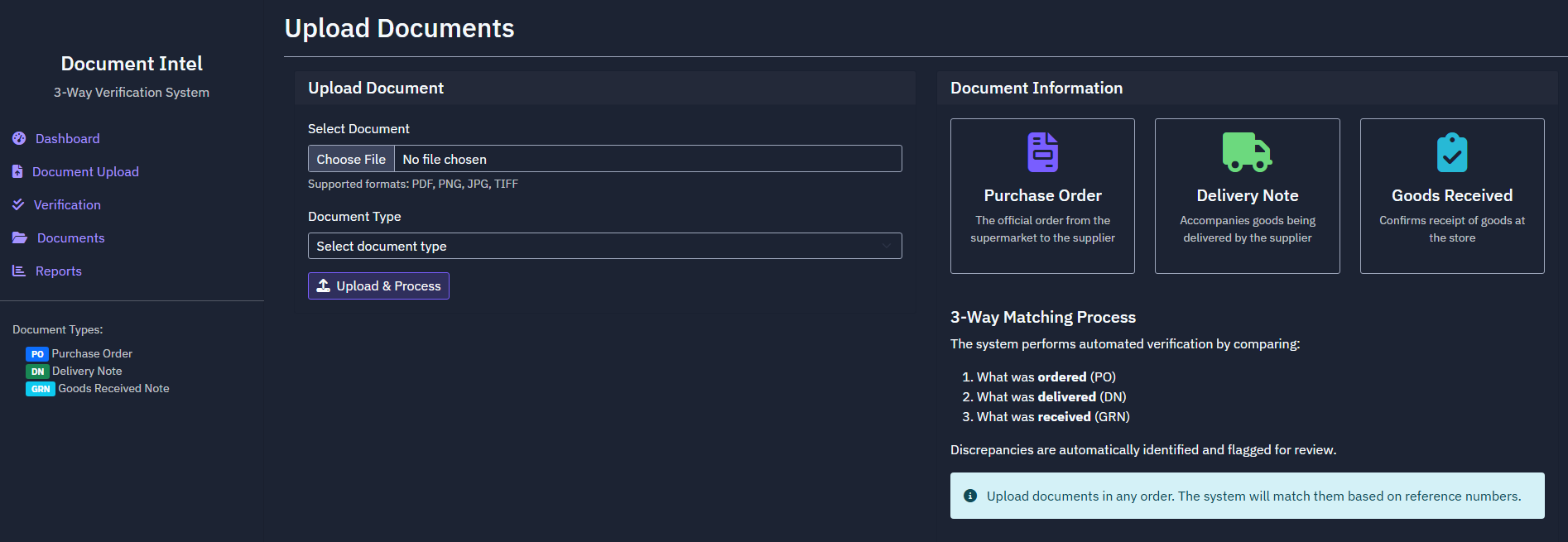

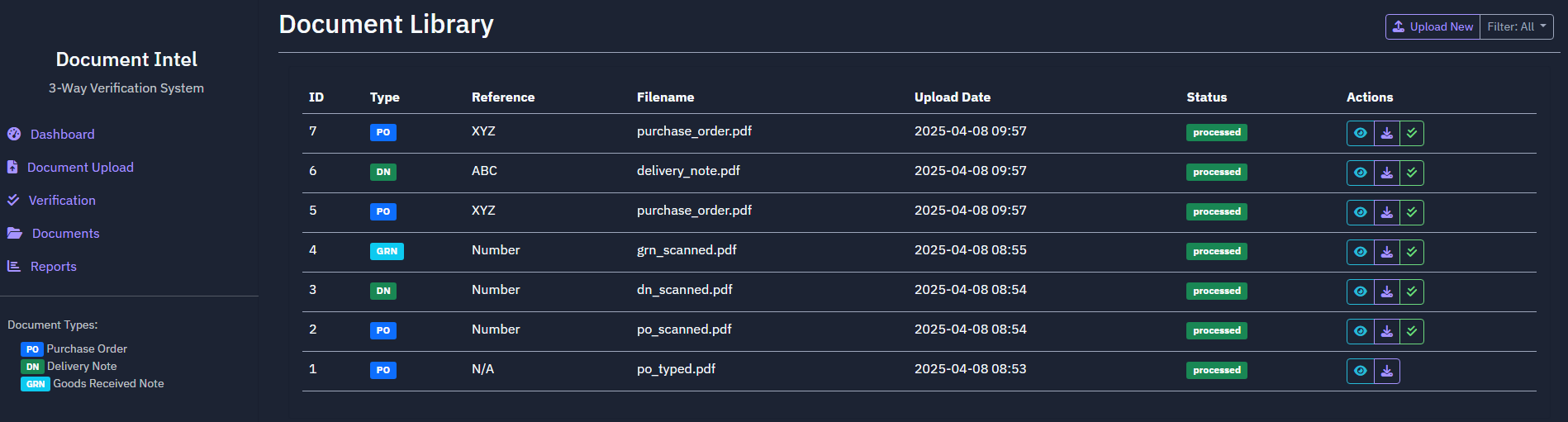

- 👉 OCR (Optical Character Recognition) for multi-format invoice text extraction (PDF, Excel, scanned docs)

- 👉 Python-based Rule Engine for configurable validation logic

- 👉 AI/ML Models to detect patterns, anomalies, and mismatches

- 👉 Azure Blob Storage & Azure Functions for secure storage and processing

- 👉 Power BI Dashboards for tracking validation status, discrepancies, and approvals

Solutions Delivered

Smart Invoice Extraction Engine :

- 👉 Used OCR to read and extract key data points from invoices in diverse formats

- 👉 Normalized data structures for standardized comparison

AI-Based Matching and Validation:

- 👉 Automatically matched extracted invoice data with PO records from the operator’s internal systems

- 👉 Detected anomalies such as rate deviations, unexpected tax, or quantity mismatches

- 👉 Confidence scoring for prioritizing risky invoices

Exception Management Workflow :

- 👉 Exception reports generated for mismatches with audit-ready details

- 👉 Approval workflows enabled for finance teams to quickly review and take action

Partner-Specific Rule Configurations:

- 👉 Custom rules tailored to each partner’s contract terms and billing behaviors

- 👉 Support for multi-currency and regional tax validation

Impact Delivered :

- 👉 70%+ reduction in manual effort for invoice validation

- 👉 Faster invoice approvals and reduced financial cycle times

- 👉 Improved accuracy and compliance in roaming settlements

- 👉 Greater transparency through audit trails and dashboards

- 👉 Cost savings by avoiding overpayment and billing errors

Innovation Highlight:

The solution’s ability to use OCR + AI to read complex invoice formats and apply partner-specific rules gave the operator a scalable, intelligent validation system—without needing to overhaul existing network or billing systems.

The Road Ahead

Following the success of roaming invoice validation, the operator is exploring similar AI-powered automation for areas like interconnect billing, partner settlements, and financial compliance reporting—continuing its journey toward intelligent finance operations.